Are you a small business owner or a truck driver looking to maximize your tax deductions? Look no further! We have compiled a list of tax deduction worksheets and expense templates that will help you streamline your tax filing process.

Tax Deduction Worksheet for Small Businesses

Running a small business requires careful budgeting and financial planning. This tax deduction worksheet for small businesses provides a comprehensive overview of the deductions you may qualify for. By filling out this worksheet, you can ensure that you don’t miss out on any deductible expenses. From office supplies to advertising expenses, this worksheet covers it all.

Running a small business requires careful budgeting and financial planning. This tax deduction worksheet for small businesses provides a comprehensive overview of the deductions you may qualify for. By filling out this worksheet, you can ensure that you don’t miss out on any deductible expenses. From office supplies to advertising expenses, this worksheet covers it all.

Truck Driver Tax Deductions Worksheet

Truck drivers face unique expenses that can be deducted on their tax returns. This truck driver tax deductions worksheet is specifically designed to help truck drivers track their deductible expenses. From fuel costs to maintenance expenses, this worksheet will assist you in maximizing your deductions and lowering your taxable income.

Truck drivers face unique expenses that can be deducted on their tax returns. This truck driver tax deductions worksheet is specifically designed to help truck drivers track their deductible expenses. From fuel costs to maintenance expenses, this worksheet will assist you in maximizing your deductions and lowering your taxable income.

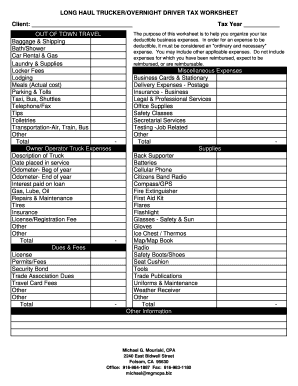

Truck Driver Expenses Worksheet Form

Properly documenting your expenses is crucial when it comes to claiming deductions. This truck driver expenses worksheet form allows you to record all your expenses in one place. By filling out this form accurately, you can ensure that you have all the necessary information when filing your tax return. Don’t miss out on any deductions!

Properly documenting your expenses is crucial when it comes to claiming deductions. This truck driver expenses worksheet form allows you to record all your expenses in one place. By filling out this form accurately, you can ensure that you have all the necessary information when filing your tax return. Don’t miss out on any deductions!

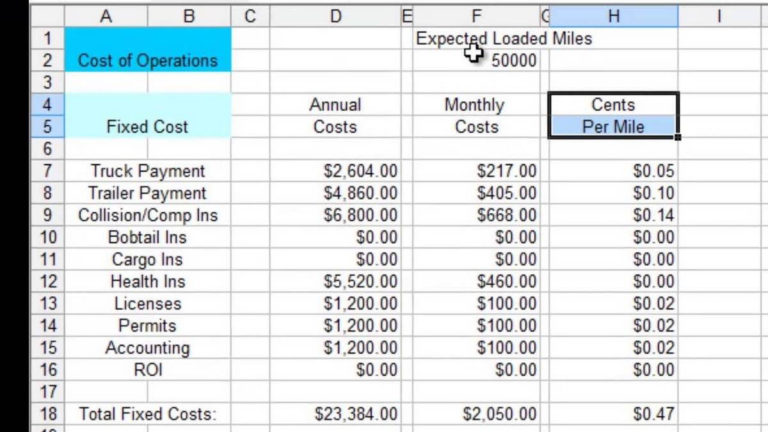

Truck Expenses Worksheet

If you prefer a spreadsheet format, this truck expenses worksheet is perfect for you. Keep track of all your truck-related expenses, including fuel, repairs, insurance, and more. This worksheet is customizable, allowing you to tailor it to your specific needs. Stay organized and claim every expense!

If you prefer a spreadsheet format, this truck expenses worksheet is perfect for you. Keep track of all your truck-related expenses, including fuel, repairs, insurance, and more. This worksheet is customizable, allowing you to tailor it to your specific needs. Stay organized and claim every expense!

Free Owner Operator Expense Spreadsheet

If you’re an owner-operator in the trucking industry, this free expense spreadsheet will be your best friend. It provides an all-in-one solution for tracking your income and expenses. Stay on top of your financials and make tax time a breeze with this comprehensive spreadsheet template.

If you’re an owner-operator in the trucking industry, this free expense spreadsheet will be your best friend. It provides an all-in-one solution for tracking your income and expenses. Stay on top of your financials and make tax time a breeze with this comprehensive spreadsheet template.

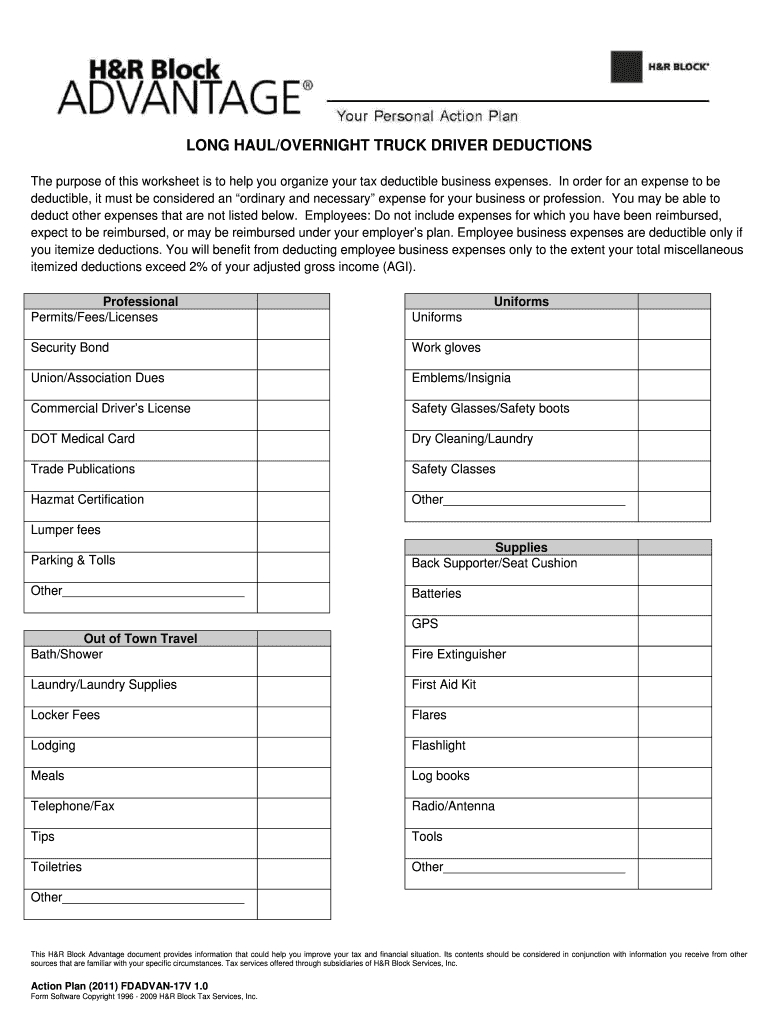

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

This printable worksheet is specifically designed for truck drivers who operate under the owner-operator model. It allows you to document your expenses and deductions in a clear and organized manner. By using this worksheet, you can ensure that you don’t miss out on any eligible deductions when filing your taxes.

This printable worksheet is specifically designed for truck drivers who operate under the owner-operator model. It allows you to document your expenses and deductions in a clear and organized manner. By using this worksheet, you can ensure that you don’t miss out on any eligible deductions when filing your taxes.

These tax deduction worksheets and expense templates are valuable resources for small business owners and truck drivers alike. By utilizing these tools, you can take full advantage of available tax deductions and minimize your tax liability. Keep track of your expenses, stay organized, and maximize your deductions with ease.

Disclaimer: The data used in this post is for informational purposes only and should not be considered as financial or tax advice. Always consult with a qualified tax professional for personalized guidance.