A mileage log is a crucial tool for professionals who use their vehicles for work-related purposes. It allows individuals to accurately track their mileage and expenses, which is essential for tax deductions and reimbursements. Whether you’re a freelance contractor, a small business owner, or a sales representative, maintaining a mileage log can save you valuable time and money.

Mileage Log Templates

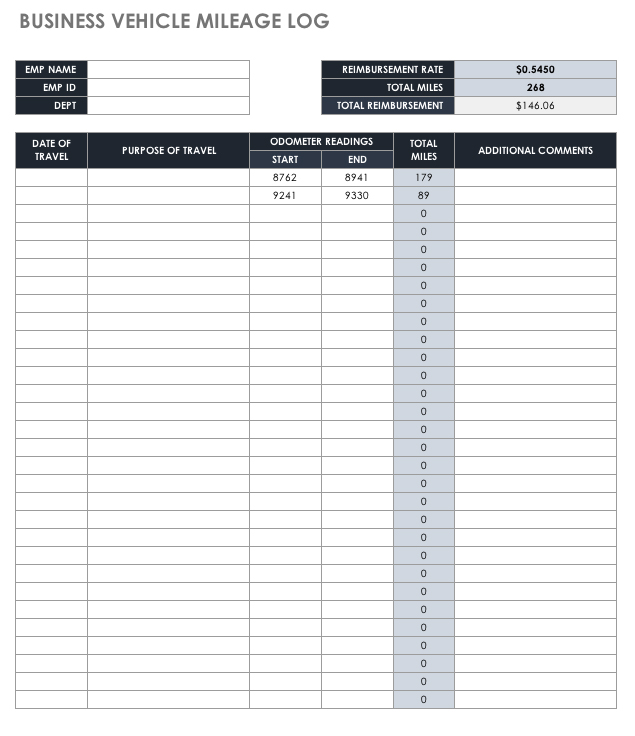

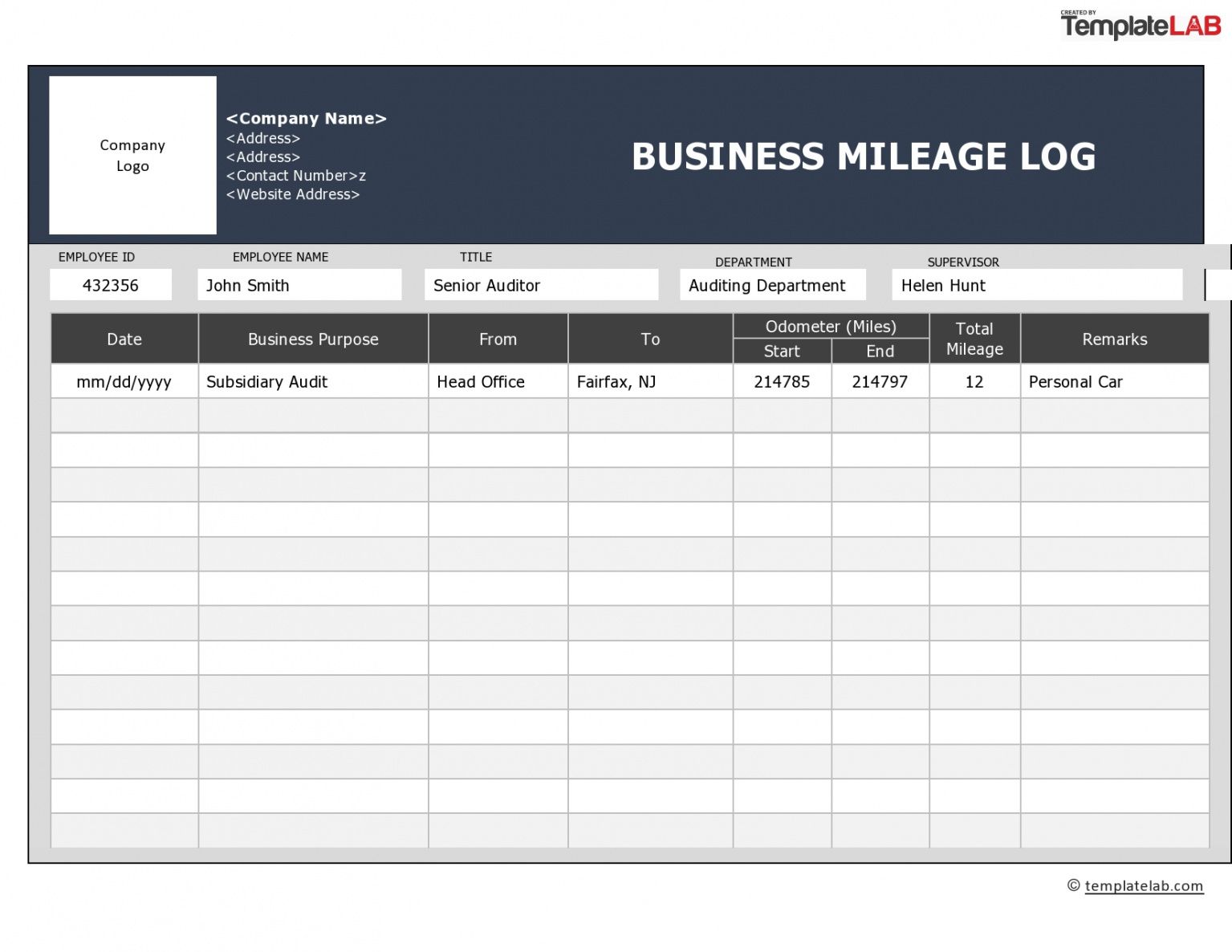

One of the most efficient ways to create a mileage log is by using a template. These templates come in various formats, such as Excel spreadsheets or printable PDF documents. They provide a structured layout where you can input your mileage details, including the date, starting and ending locations, purpose of the trip, and total miles traveled.

One of the most efficient ways to create a mileage log is by using a template. These templates come in various formats, such as Excel spreadsheets or printable PDF documents. They provide a structured layout where you can input your mileage details, including the date, starting and ending locations, purpose of the trip, and total miles traveled.

The Benefits of Using a Mileage Log Template

Not only do mileage log templates provide a convenient way to track your mileage, but they also offer several other benefits:

Not only do mileage log templates provide a convenient way to track your mileage, but they also offer several other benefits:

- Accuracy: By using a pre-designed template, you reduce the chances of making errors or forgetting to record trips. The structured format ensures all necessary information is captured.

- Time-saving: Instead of creating a mileage log from scratch, templates allow you to simply fill in the required fields. This saves you valuable time that can be better utilized for other business tasks.

- Organization: With a mileage log template, you can easily organize and categorize your mileage records. This is particularly useful when it comes time to report your business expenses or file for tax deductions.

- Consistency: Templates ensure that each entry follows the same format, making it easier to review and analyze your mileage data. This consistency is especially helpful when assessing your vehicle’s efficiency and identifying areas for improvement.

A suitable mileage log template should also accommodate additional information, such as toll fees, parking expenses, and any other relevant costs associated with the trip. By including these details, you can maximize your potential deductions and accurately track your overall expenses.

Maintaining Your Mileage Log

Consistency is key when it comes to maintaining your mileage log. It’s essential to record each business-related trip promptly to avoid missing any details. Make it a habit to complete your mileage log at the end of each day, ensuring that you capture all necessary information while it’s still fresh in your mind.

Consistency is key when it comes to maintaining your mileage log. It’s essential to record each business-related trip promptly to avoid missing any details. Make it a habit to complete your mileage log at the end of each day, ensuring that you capture all necessary information while it’s still fresh in your mind.

Additionally, it’s a good practice to keep all supporting documentation related to your mileage, such as gas receipts, parking receipts, and toll receipts. These documents serve as evidence in case of an audit and further substantiate your expenses.

Remember to update your mileage log regularly and keep it organized. Whether you choose to maintain a digital or physical log, create a system that works for you. You can also consider utilizing mileage tracking apps that automatically record your trips using GPS technology.

Conclusion

Using a mileage log template is an invaluable practice for professionals who rely on their vehicles for work-related purposes. It helps you accurately track your mileage, record relevant expenses, and maintain organized records for tax deductions and reimbursement purposes. By incorporating a mileage log into your routine, you can simplify your business finances and ensure that you are effectively managing your vehicle-related expenses.

Remember to customize your chosen template to suit your specific needs, including additional fields for expenses and relevant trip details. With the right mileage log template and consistent recording habits, you can streamline your administrative processes and focus on what matters most – growing your professional endeavors.