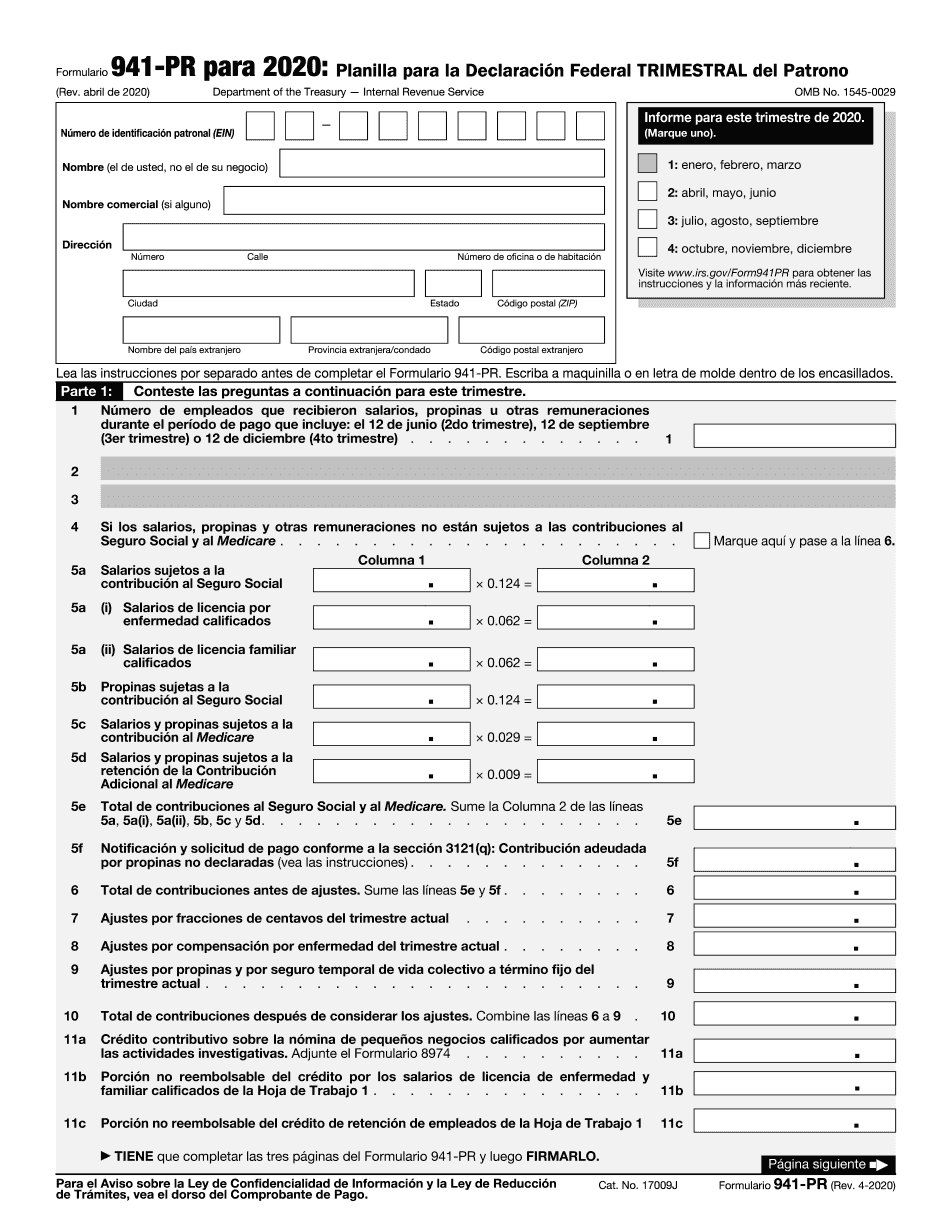

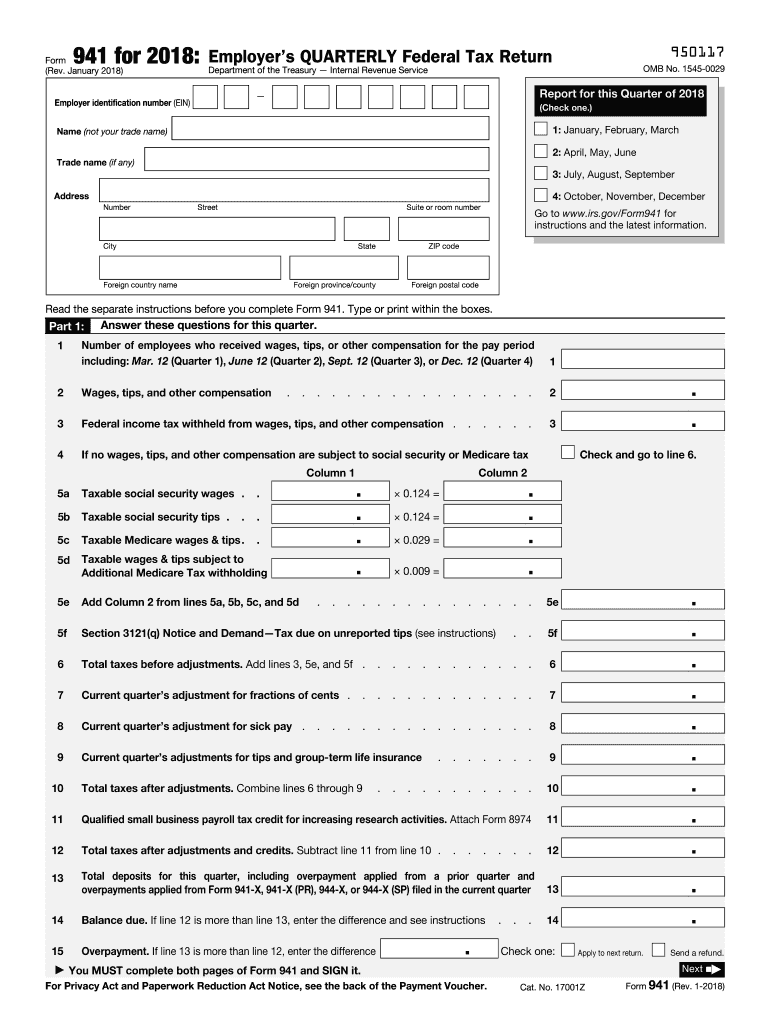

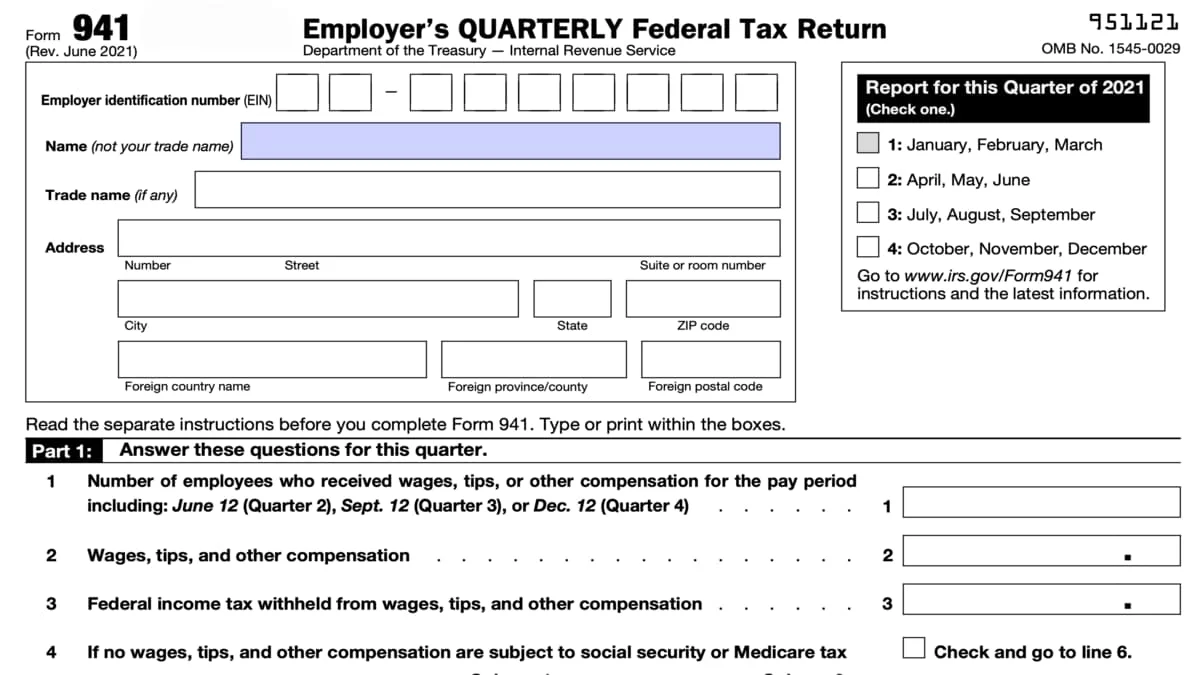

Form 941 is an important document for employers in the United States. It is used to report employment taxes, including federal income tax withholding, Social Security tax, and Medicare tax, to the Internal Revenue Service (IRS) on a quarterly basis. Understanding how to properly fill out and file Form 941 is crucial to ensuring compliance with the IRS regulations.

Form 941

The Form 941 is necessary for employers to report the amount of federal income tax, Social Security tax, and Medicare tax withheld from employees’ wages. It also includes information about the employer’s portion of Social Security and Medicare taxes. Employers must file Form 941 quarterly, by the last day of the month following the end of each quarter.

The Form 941 is necessary for employers to report the amount of federal income tax, Social Security tax, and Medicare tax withheld from employees’ wages. It also includes information about the employer’s portion of Social Security and Medicare taxes. Employers must file Form 941 quarterly, by the last day of the month following the end of each quarter.

Instructions & Info on Tax Form 941

Filing Form 941 accurately is essential to avoid penalties or additional payments. The IRS provides detailed instructions for completing the form, which can be found on their official website. It is essential to review these instructions thoroughly to ensure accurate reporting.

Filing Form 941 accurately is essential to avoid penalties or additional payments. The IRS provides detailed instructions for completing the form, which can be found on their official website. It is essential to review these instructions thoroughly to ensure accurate reporting.

Form 941 Schedule B

Form 941 Schedule B is used to report the employer’s liability for Social Security and Medicare taxes on tips received by employees. This schedule is required if the total tips reported by employees exceed $20 in any given calendar month.

Form 941 Schedule B is used to report the employer’s liability for Social Security and Medicare taxes on tips received by employees. This schedule is required if the total tips reported by employees exceed $20 in any given calendar month.

How to File Form 941

Filing Form 941 can be done electronically or through traditional mail. Many employers choose to file electronically as it is convenient and faster. However, it is essential to follow the IRS guidelines for electronic filing to ensure compliance.

Filing Form 941 can be done electronically or through traditional mail. Many employers choose to file electronically as it is convenient and faster. However, it is essential to follow the IRS guidelines for electronic filing to ensure compliance.

IRS Form 941 Fill Online

The IRS provides the option to fill out Form 941 online using their official website. This online fillable form simplifies the process by providing interactive fields that guide employers through each section.

The IRS provides the option to fill out Form 941 online using their official website. This online fillable form simplifies the process by providing interactive fields that guide employers through each section.

Free Printable Form 941

For those who prefer to complete the form manually, printable versions of Form 941 are available online. These can be downloaded, printed, and filled out by hand. It is important to ensure accuracy and legibility when completing the form manually.

For those who prefer to complete the form manually, printable versions of Form 941 are available online. These can be downloaded, printed, and filled out by hand. It is important to ensure accuracy and legibility when completing the form manually.

How to fill out Form 941

Filling out Form 941 can be a daunting task for some employers. However, with the right guidance, it can be completed accurately and efficiently. Online tutorials and resources are available to help employers understand each section of the form and provide step-by-step instructions on how to fill it out correctly.

Filling out Form 941 can be a daunting task for some employers. However, with the right guidance, it can be completed accurately and efficiently. Online tutorials and resources are available to help employers understand each section of the form and provide step-by-step instructions on how to fill it out correctly.

In conclusion, Form 941 is a vital document for employers in the United States to report employment taxes. Accurate and timely filing of Form 941 is crucial to remain compliant with IRS regulations. Whether employers choose to fill out the form electronically or manually, it is important to carefully follow the instructions provided by the IRS. By understanding the purpose and requirements of Form 941, employers can fulfill their tax obligations and avoid penalties.