As we dive into the world of tax forms and financial documents, let’s take a moment to shine a light on the 1099 forms. These little pieces of paper may seem mundane to some, but they hold great importance when it comes to our financial lives. From tax reporting to debt cancellations, the 1099 forms play a significant role in our interactions with the Internal Revenue Service (IRS).

1099 Forms 2021 Printable

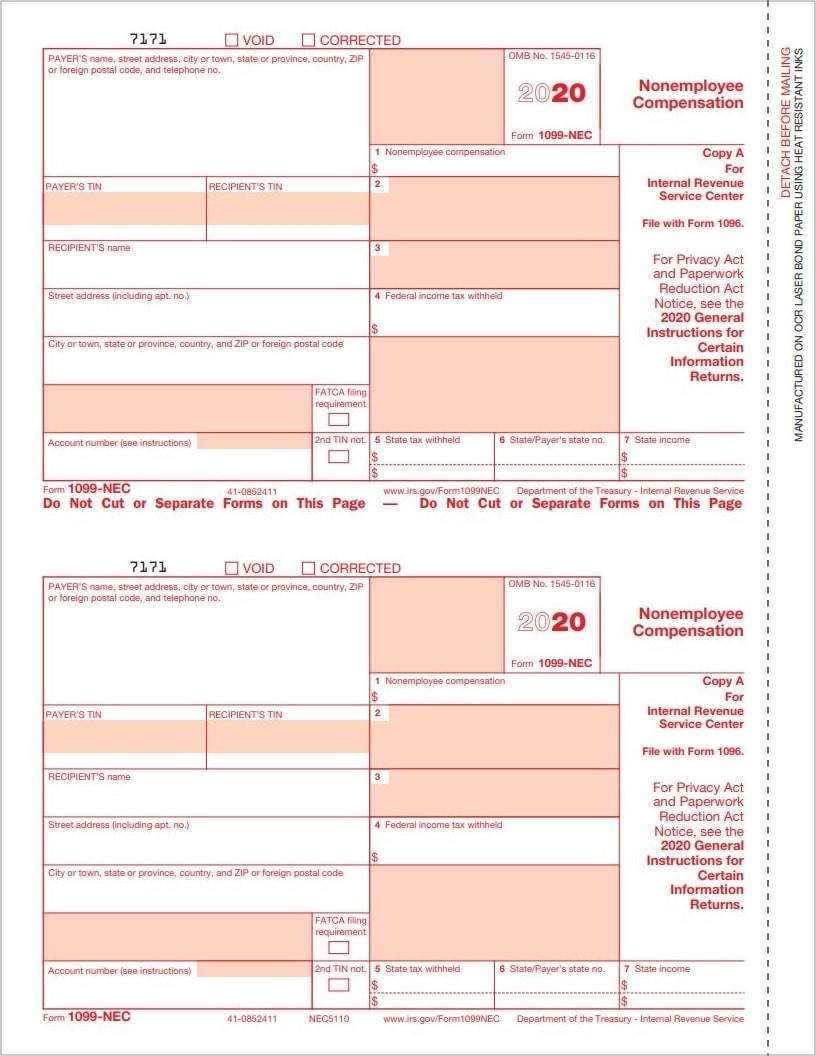

Let’s start with the basics – the 1099 forms for the year 2021. These printable forms serve as a tool to report various types of income that we receive throughout the year. Whether it’s income from self-employment, interest, dividends, or even debt cancellation, the 1099 forms help us stay on top of our tax responsibilities.

Let’s start with the basics – the 1099 forms for the year 2021. These printable forms serve as a tool to report various types of income that we receive throughout the year. Whether it’s income from self-employment, interest, dividends, or even debt cancellation, the 1099 forms help us stay on top of our tax responsibilities.

Instructions for Forms 1099-MISC and 1099-NEC (2021)

Understanding the intricacies of the 1099 forms can sometimes feel like navigating a complex maze. But fear not! The Internal Revenue Service (IRS) has provided detailed instructions to guide us through filling out the Forms 1099-MISC and 1099-NEC. These instructions are a valuable resource for ensuring accurate reporting and compliance with tax regulations.

Understanding the intricacies of the 1099 forms can sometimes feel like navigating a complex maze. But fear not! The Internal Revenue Service (IRS) has provided detailed instructions to guide us through filling out the Forms 1099-MISC and 1099-NEC. These instructions are a valuable resource for ensuring accurate reporting and compliance with tax regulations.

Blank 1099 Form 2021

Sometimes, we may find ourselves in need of a blank 1099 form. Whether it’s to report income as an independent contractor or to issue a payment to a freelancer, having a printable blank form can be incredibly useful. With the advent of digital signatures and online document management, platforms like eSign Genie make it easier than ever to fill out and submit these forms securely.

Sometimes, we may find ourselves in need of a blank 1099 form. Whether it’s to report income as an independent contractor or to issue a payment to a freelancer, having a printable blank form can be incredibly useful. With the advent of digital signatures and online document management, platforms like eSign Genie make it easier than ever to fill out and submit these forms securely.

Form 1099 Definition

:max_bytes(150000):strip_icc()/1099r-eda9fdcb4d82449da27f9f30a318aaa3.jpg) Form 1099 is a generic term used by the IRS to encompass several different types of information returns. These returns are filed by payers to report various types of income to the IRS and the recipients of that income. It is essential to understand the different variations of Form 1099 and their specific reporting requirements to ensure accuracy in tax reporting.

Form 1099 is a generic term used by the IRS to encompass several different types of information returns. These returns are filed by payers to report various types of income to the IRS and the recipients of that income. It is essential to understand the different variations of Form 1099 and their specific reporting requirements to ensure accuracy in tax reporting.

What To Do With A 1099 from Coinbase or Another Exchange

In the ever-evolving world of cryptocurrency, the 1099 forms have gained additional significance. If you’ve engaged in cryptocurrency trading on platforms like Coinbase, you may receive a Form 1099 from them. TokenTax shares insightful guidance on how to handle these 1099 forms, ensuring compliance with tax regulations.

In the ever-evolving world of cryptocurrency, the 1099 forms have gained additional significance. If you’ve engaged in cryptocurrency trading on platforms like Coinbase, you may receive a Form 1099 from them. TokenTax shares insightful guidance on how to handle these 1099 forms, ensuring compliance with tax regulations.

As we complete our journey through the world of 1099 forms, it’s crucial to remember that these forms hold valuable information and warrant our attention. Whether it’s printing out the necessary documents, understanding the instructions, or seeking guidance on reporting cryptocurrency transactions, the 1099 forms help us stay on top of our financial responsibilities. So, embrace the power of these forms, and navigate your financial landscape with confidence!